Millionaire way of success: Multiple streams of income

EYE OPENER FACT: Most millionaires have over 3 streams of income.

In this article, we will discuss 5 income streams that will not only help you grow your wealth but can also make you the next millionaire if the correct strategy is followed. A BONUS TIP will also be given at the end.

It's quite intriguing to study millionaires as you will find out that they are actually the same as you. They are all regular, ordinary people BUT they are highly disciplined and don't allow themselves to lose their focus. It's not always the case to work harder or smarter every time BUT sometimes it's about working differently like Bill Gates, Mark Zuckerberg, Jeff Bezos, etc. They first explore a problem that is faced by almost all people and then they provide a solution for it and make it accessible to the masses. Another way to accumulate large wealth which is also our topic of discussion is having multiple streams of income.

A 2018 article on CNBC highlighted the following intriguing aspect of millionaires: 65% of millionaires have three streams of income 45% of millionaires have four sources of income 29% of millionaires have five or more income streams

There is a famous quote: Your salary is the bribe they give you to forget your dreams. This quote is spot on as over 95% are living in misery and are not satisfied with their lives. And most of them are people who are having only one source of income. They work a 9-5 job, 5 days a week, and receive a paycheck by the end of every month. They become machines with dull minds and follow the same routine for the rest of their lives till their retirement and end up having no money if something financial crisis comes their way. According to CNBC report, over half of millionaires have 3 income streams. The high and more passive income streams will help you to become financially stable enough even in the extreme financial crisis patch of your life.

There is a famous quote: Your salary is the bribe they give you to forget your dreams. This quote is spot on as over 95% are living in misery and are not satisfied with their lives. And most of them are people who are having only one source of income. They work a 9-5 job, 5 days a week, and receive a paycheck by the end of every month. They become machines with dull minds and follow the same routine for the rest of their lives till their retirement and end up having no money if something financial crisis comes their way. According to CNBC report, over half of millionaires have 3 income streams. The high and more passive income streams will help you to become financially stable enough even in the extreme financial crisis patch of your life.

Having multiple income streams is a powerful wealth-building tool because the right streams can increase your wealth passively. If you're looking to grow your wealth like the well-off do, here are the top five streams of income that will boost your bottom line:

1. Real estate syndications

For wealth accumulation, multiple passive income streams are the primary and most important step that almost every millionaire will follow. Everyone has 24 hrs of time in a day. So you can only accumulate wealth if you act smartly by adopting multiple streams of passive income rather than working actively on a single stream which will still bring you under the umbrella of those hand-to-mouth feeding people and will be stuck in a regular, boring 9-5 job for the rest of your life.

Real estate syndications are one of the best passive sources of income. A syndication is a group of investors that purchase a particular multi-family or commercial property. These investments typically run for about five years and feature yearly returns of around 8%. On top of those above-average returns, syndications sell the purchased building, sometimes providing investors with a 30%-50% lump-sum return at the end of those five years.

Almost all investments involve the risk of losing money but it is not uncommon for real estate syndications to lose any invested money rather it gives returns of 80-100% profit over 5 years. An investment that potentially doubles your money every five years passively? That's why syndications are so powerful for wealth-building and make their place at top of the list in this article!

Almost all investments involve the risk of losing money but it is not uncommon for real estate syndications to lose any invested money rather it gives returns of 80-100% profit over 5 years. An investment that potentially doubles your money every five years passively? That's why syndications are so powerful for wealth-building and make their place at top of the list in this article!

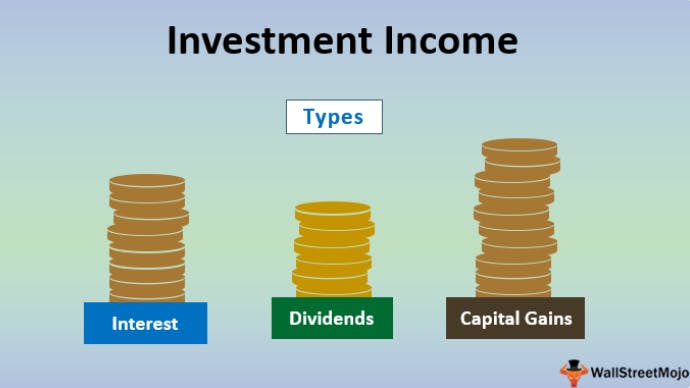

2. Investment income

Second, on our list of passive income streams which will help in growing your wealth is to have investment income. Syndications are also investments but this is a bit generalized category that includes bonds and dividends from equities. Many millionaires have CDs, participate in P2P lending, and own shares in a stock like McDonald's, which pays regular dividends.

These investments will not pay life-changing money, but as you grow your wealth, the stock market is a fantastic place to park your money safely while it grows and earns quarterly or monthly income. The key to wealth-building is diversification, and making income-generating equity or bond investments will help you achieve that goal!

These investments will not pay life-changing money, but as you grow your wealth, the stock market is a fantastic place to park your money safely while it grows and earns quarterly or monthly income. The key to wealth-building is diversification, and making income-generating equity or bond investments will help you achieve that goal!

3. Business income

Unless you have contractual obligations with your primary job not to start a side hustle, many millionaires have grown their wealth through side gigs.

Owning a business, whether making or selling something or providing services, opens up a world of limitless income possibilities. Suppose you're a developer and create a game during your off-hours. That game might develop a following and passively earn you an extra $100 per day. Just like that, your side gig is making you an additional $3,000 a month!

4. Royalties and licensing

This category is a little less common but essential. If you have the opportunity to create a product, idea, or process, you can sometimes license it out and collect a fee every time they use it.

Royalties can be on anything. You might even start a band and manage to get your songs on one of the streaming platforms. Or you might create a YouTube channel and earn somewhat passive income from views.

Royalty and licensing streams of income are fantastic because they typically are consistent. Suppose you invent the new waffle iron, for example, and a company buys that design. You will profit from every iron sold. In that case, you can expect a reasonably solid income stream for the foreseeable future!

5. Renting out your car

Peer-to-peer car rentals have become remarkably popular, thanks to a shortage on the market. When the pandemic hit, large companies like Hertz closed down and sold many of their cars. With the chip shortage, these same companies find it challenging to keep up with the increased demand.

Now, companies like Turo offer the ability for people to rent their cars to others. Some people have turned it into a side business of sorts, earning quite a bit of passive income. Indeed, one 22-year-old student in Toronto managed to develop a mini-fleet of four luxury cars.

Now, companies like Turo offer the ability for people to rent their cars to others. Some people have turned it into a side business of sorts, earning quite a bit of passive income. Indeed, one 22-year-old student in Toronto managed to develop a mini-fleet of four luxury cars.

It's not just property you can invest in and rent — if market trends continue, renting out cars is fast becoming a viable income stream!

If you want to grow your net worth, you need multiple sources of income. Relying too heavily on one stream (typically a job) is risky. What happens if you lose it? Similarly, if that singular income stream requires work, you limit how much you can make because there are only so many hours in a day that you can work.

All of the five streams of income above are fantastic ways to grow your net worth. If you haven't already, consider diversifying your portfolio by implementing the income streams suggested above!

BONUS TIP: A Unique extra income stream

When the pandemic hit, Ecommerce businesses boom exponentially. People started working in the ecommerce industry whichever they felt is more convenient to them whether its Amazon, Ebay, Walmart, etc. These markets are giant hubs of Ecommerce but it still looks quite saturated because the competition on these marketplaces makes it difficult for new sellers to survive in price wars. So a better option is Facebook Marketplace and Facebook Shops which are not as saturated and the returns on products could range from 20%-80% profits. To help you and get you started in the Ecommerce business of dropshipping mode of selling on Facebook Marketplace and Facebook Shops, there is a tool MarketplaceFlow marketplaceflow.io which will not only save you time but will also make your tasks easier. MarketplaceFlow has multiple features any Dropshipper would require to start a business like a product research tool, product listing, bulk listing, tracking number generation, customizable template options, and many more.

Here is some more information about MarketplaceFlow which will help you in understanding the tool and its functionality and advantageous characteristics.

How to Master Facebook Dropshipping in 2022 with MarketplaceFlow Reasons why to choose MarketplaceFlow What Makes MarketplaceFlow Different Advantages Of using MarketplaceFlow for Dropshipping

Conclusion:

The main problem is people are afraid of investing money. They are fine and happy to see money in their bank accounts whose value remains the same no matter what. More importantly, its value might even decrease with time as inflation in the world rises.

The main problem in which most people lag is their own self-confidence. They are not confident that their investments can bring a huge fortune in return. Money will never grow if you keep it in your bank account rather you should invest them in at least 3 different income streams. Believe in yourself and go for it. TOO MUCH THINKING will never help you rather it will keep you depressed about your past and will keep you worried about your future.

QUOTE from a Movie (KungFu Panda): YESTERDAY IS HISTORY, TOMORROW IS A MYSTERY BUT TODAY IS A GIFT, THAT IS WHY IT'S CALLED PRESENT.

So, live today without burdening yourself too much for your future and being depressed with your past. Your competitor is yourself. Try to improve yourself and become a better version of yourself every day.

So, live today without burdening yourself too much for your future and being depressed with your past. Your competitor is yourself. Try to improve yourself and become a better version of yourself every day.